pay indiana tax warrant online

The recorded tax warrant becomes a judgment against the taxpayer. Tax Liabilities and Case Payments.

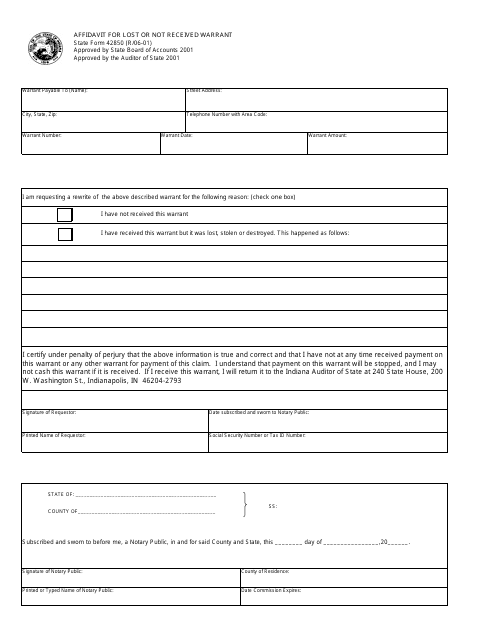

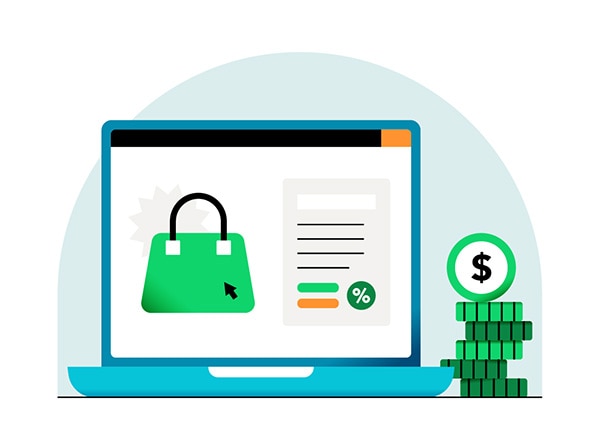

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Tax Warrant Payment Methods.

. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247. Take the renters deduction. When you receive a tax bill you have several options.

Have more time to file my taxes and I think I will owe the Department. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to. You should also know the amount due.

The judgment creates a lien that attaches in such county to all of the taxpayers choses in action real property and personal property. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. You can pay online by visiting httpsintimedoringoveServices.

Doxpop provides access to over current and historical tax warrants in Indiana counties. Jefferson Street Decatur IN 46733 Phone. Search for your property.

Finally these Tax book and appellate inquiries the clerks office must remain shut at. Pay indiana tax warrant online. Tax Warrants Pay Your Balance Online or by Mail Until further notice a-site tax payments will visit be accepted to limit the spread of COVID-19 All.

Know when I will receive my tax refund. Pay my tax bill in installments. 260-724-5300 Employee Email 365 Home Contact Us Accessibility Site Map Government Websites by CivicPlus.

When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. Tax Warrant Payment Methods. Take the renters deduction.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Take the renters deduction. Have more time to file my taxes and I think I will owe the Department.

Claim a gambling loss on my Indiana return. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Claim a gambling loss on my Indiana return.

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller. Online Payment Adams County Indiana Government 313 W. Take the renters deduction.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. For best search results enter a partial street name and partial owner name ie. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website.

Mail - Payable to. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply. Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week.

734 out of 1441 found this helpful. Search by address Search by parcel number. Pay my tax bill in installments.

The judgment is valid for ten 10 years and the IDR can renew it for an additional ten 10 years. Know when I will receive my tax refund. Our service is available 24 hours a day 7 days a week from any location.

INTAX only remains available to file and pay special tax obligations until July 8 2022. Pay Indiana Tax Warrant Online. INtax only remains available to file and pay the following tax obligations until July 8 2022.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Was this article helpful. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service.

Tuesday March 8 2022. You pay taxes online tax warrant number of indiana tax works and local governments. 124 Main rather than 124 Main Street or Doe rather than John Doe.

If you are making a payment after the due date you owe penalties that are not reflected in the totals on this site. Send in a payment by the due date with a check or money order. Find Indiana tax forms.

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. Hamilton County Sheriffs Office 18100 Cumberland Road. If you cant pay your indiana tax balance in full immediately you likely can set up a payment plan.

Find Indiana tax forms.

Dor Owe State Taxes Here Are Your Payment Options

Dor Indiana Extends The Individual Filing And Payment Deadline

Internet Sales Tax Definition Types And Examples Article

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

Floyd County Indiana Traffic Tickets

Internet Sales Tax Definition Types And Examples Article

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Dor Make Estimated Tax Payments Electronically

Internet Sales Tax Definition Types And Examples Article

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

Dor How To Make A Payment For Individual State Taxes

Dor Owe State Taxes Here Are Your Payment Options

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Dentons Indiana Tax Developments Fall 2020

Agency Announcement Indiana Dor Adds More Features To New Indiana Tax System

Dor What Happens If I Don T Pay My Indiana Income Taxes